On January 15, 2020, a California jury awarded $5.5 million to the resident of an assisted living facility who sustained serious injuries due to a fall. According to the CDC: One in four Americans aged 65+ falls each year Emergency departments treat three million older people for fall injuries each year, an average of one… Continue reading →

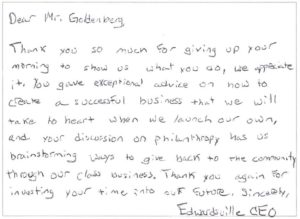

On January 15, 2020, a California jury awarded $5.5 million to the resident of an assisted living facility who sustained serious injuries due to a fall.

According to the CDC:

- One in four Americans aged 65+ falls each year

- Emergency departments treat three million older people for fall injuries each year, an average of one every eleven seconds

- One in five falls causes a serious injury, such as broken bones or a head injury

With the increasing growth of the Baby Boomers entering old age, fall injuries are increasingly common in assisted living facilities.

Assisted living facilities rarely accept responsibility for fall injuries. They claim residents live independently in their own quarters and receive limited assistance with meals, medication and housekeeping service. Even for those who receive enhanced services or additional supervision, they argue it is not reasonable to anticipate when the residents might fall.

However, assisted living facilities have a legal obligation to identify and address risks of their residents, including their specific fall risks.

What to do if your loved one falls in an assisted living facility?

If a fall occurs, first and foremost, ensure a thorough medical evaluation is completed. This is particularly important if the resident suffers from any cognitive deficits or confusion. The fall injuries may not be recognized immediately, even if one is not confused.

Second, if the facility cannot adequately explain the event in detail or you suspect something is wrong, calling the abuse and neglect hotline is an option. The Missouri Department of Health and Senior Services hotline is 1-800-392-0210. The Illinois Department of Public Health hotline is 800-252-4343. State inspectors will show up for an unannounced inspection of the facility, demand the resident’s records and conduct employee interviews.

Investigating Liability of Assisted Living Facility After a Fall?

Complete records from the assisted living facility are critical, but it is all too often an insurmountable hurdle for those unfamiliar with the legal paperwork. Even after submitting all the correct paperwork, one may not receive complete records unless and until someone familiar with such records confronts the facility about what is missing. One such facility refused to produce its records after five requests. It took filing a lawsuit to get records.

Liability might be due to an incomplete or inaccurate assessment, the wrong care plan or the failure of staff to follow the plan. A breakdown in leadership tends to cause a cascade of problems. On the other hand, it is also possible that the facility was doing everything it was supposed to do.

What Should You Do After a Loved One is Injured?

ACT QUICKLY!!! The law has certain deadlines to assert claims. Oftentimes, it takes months of gathering enough information to evaluate the viability of a lawsuit.

Some people do not do anything. They reason that it does not heal the injury or bring their deceased loved one back. Others make a claim because they do not want someone else to suffer the same fate.

Most assisted living facilities are owned by corporate conglomerates that are more focused on profits than patient care. If left unaccountable, such facilities will not change their dangerous ways. Making them accountable is one way to incentivize them to do things the right way.

Assisted living facilities absolutely must ensure that services they provide are sufficient to meet the needs of their residents. If a resident requires more assistance than the facility provides, that resident cannot be admitted or remain in the facility.

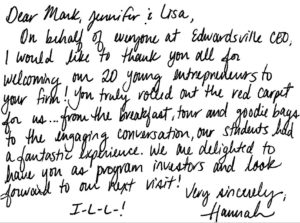

In evaluating and prosecuting lawsuits against assisted living facilities, Goldenberg, Heller & Antognoli stays abreast of the statutory and regulatory requirements. Our attorneys know how to gather the available evidence and retain some of the best experts the medical profession has to offer. We would be happy to talk with you if you or your loved one who has suffered an injury in an assisted living facility.